SEBI-Registered, Research-Driven Market Analysis

Structured Market Research for Investors & Traders Who Value Process Over Predictions

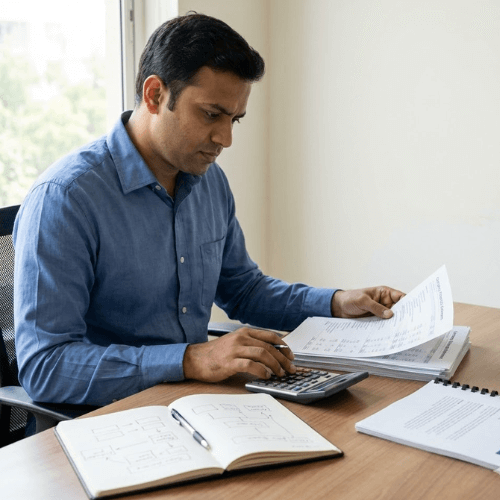

Nirvana Research is led by CA Chintan Bajaj (CA, ACCA, MBA) — a SEBI-registered Research Analyst providing disciplined, probability-based research across Equities, Derivatives (F&O), and Commodities.

This is not a TIPS channel.

This is a RESEARCH DESK built for serious market participants.

SEBI-Registered Research Analyst

Education-First, Research-Led Approach

Equity · F&O · Commodities Coverage

Risk Management Before Returns

SEBI-Registered, Research-Driven Market Analysis

Structured Market Research for Investors & Traders Who Value Process Over Predictions

Nirvana Research is led by CA Chintan Bajaj (CA, ACCA, MBA) — a SEBI-registered Research Analyst providing disciplined, probability-based research across Equities, Derivatives (F&O), and Commodities.

This is not a tips channel.

This is a research desk built for serious market participants.

SEBI-Registered Research Analyst

Education-First, Research-Led Approach

Equity · F&O · Commodities Coverage

Risk Management Before Returns

Who This Is Built For !!

This Is Built For You If You :

Prefer logic and structured research over Telegram tips

Want to understand why a trade or investment is taken

Actively participate in equity, options, or commodity markets

Care about risk, drawdowns, and capital preservation

Have a job or business and need structured, time-efficient research

This Is Not For You If:

You want guaranteed returns ixed income-style certainty, or any form of risk-free outcomes

You are seeking shortcuts, fast results without putting in the effort to understand the market

You are looking for intraday tips or “sure-shot calls”

You are uncomfortable with drawdowns or temporary losses

You are not interested in learning the process behind decisions

This filtering is intentional. The platform is designed to attract serious participants and discourage misaligned users.

Who This Is Built For !!

This Is Built For You If You :

Prefer logic and structured research over Telegram tips

Want to understand why a trade or investment is taken

Actively participate in equity, options, or commodity markets

Care about risk, drawdowns, and capital preservation

Have a job or business and need structured, time-efficient research

This Is Not For You If:

You want guaranteed returns ixed income-style certainty, or any form of risk-free outcomes

You are seeking shortcuts, fast results without putting in the effort to understand the market

You are looking for intraday tips or “sure-shot calls”

You are uncomfortable with drawdowns or temporary losses

You are not interested in learning the process behind decisions

This filtering is intentional. The platform is designed to attract serious participants and discourage misaligned users.

Why Nirvana Research Is Different

Nirvana Research is built on a simple philosophy:

Markets reward Discipline, not Excitement.

Unlike unregulated tip providers and hype-driven platforms, the focus here is on:

Research logic

Risk frameworks

Probability-based decision making

Capital protection & downside management

Long-term consistency & process integrity

Multi-Asset Research Coverage

Nirvana Research covers three distinct market segments, each with its own framework.

No single methodology is forced across all assets.

Equities

- Long-term and swing opportunities

- Business quality, structure, and valuation analysis

- Risk-reward based allocation logic

Derivatives (F&O)

- Options strategies built on probability

- Defined-risk setups

- Volatility, Greeks, and structure-based analysis

Commodities

- Macro and technical alignment

- Risk-controlled directional setups

- Clearly defined invalidation levels

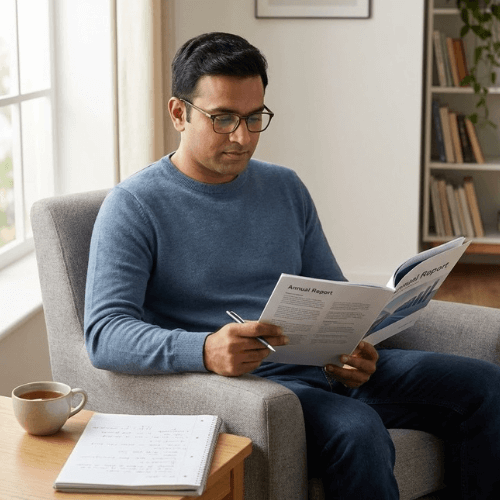

What Members Actually Receive

All deliverables are realistic, structured, and process-driven.

Framework-Based Trade & Investment Ideas

With clear reasoning, structure, and risk considerations

Asset-Specific Research Insights

Separate logic for equity, F&O, and commodities — no generic analysis

Weekly Research Notes

Concise market context, key levels, and research observations

Educational Breakdowns

Explaining how to think, not what to blindly follow

Risk & Position Sizing Guidance

Because survival matters more than returns

Periodic Live Sessions / Notes

Focused on reasoning, not hype

What Members Actually Receive

All deliverables are realistic, structured, and process-driven.

Framework-Based Trade & Investment Ideas

With clear reasoning, structure, and risk considerations

Asset-Specific Research Insights

Separate logic for equity, F&O, and commodities — no generic analysis

Weekly Research Notes

Concise market context, key levels, and research observations

Educational Breakdowns

Explaining how to think, not what to blindly follow

Risk & Position Sizing Guidance

Because survival matters more than returns

Periodic Live Sessions / Notes

Focused on reasoning, not hype

Important Reality Check

This platform follows SEBI-compliant, risk-aware communication. The goal is better process, not perfection. This approach is suitable only for those who respect market risk.

No outcome is guaranteed for anyone

Research improves decision quality, not certainty

Losses are part of markets

Drawdowns will occur

About the Research Lead

Chintan Bajaj is a Chartered Accountant, ACCA and MBA, registered with SEBI as a Research Analyst.

His work is anchored in:

Research discipline

Risk management

Probability-based thinking

Structured market participation

This platform reflects a belief that long-term consistency comes from process, not predictions.

Frequently Asked Questions!!

1. Is this a tips or signals service?

No. This is not a tips or signals channel.

The focus is on structured research, frameworks, and decision logic so users understand why a trade or investment is considered — not what to blindly follow.

2. Are returns guaranteed?

No. There are no guaranteed returns in markets.

This platform is designed to improve decision quality and risk awareness, not to promise outcomes.

3. Who is this research suitable for?

This research is suitable for serious investors and traders who value:

1. process over predictions

2. risk management over excitement

3. long-term consistency over short-term wins

It is especially useful for working professionals who need structured, time-efficient insights.

4. What markets are covered under the research?

The research covers Equities, Derivatives (F&O), and Commodities, with separate frameworks for each.No single approach is forced across different asset classes.

5. Will I experience losses or drawdowns?

Yes. Losses and drawdowns are a natural part of market participation.

The goal of this research is risk-aware participation and capital preservation, not the elimination of losses.

6. Is this more about education or execution?

Both — but education comes first.

The emphasis is on helping users think correctly, understand structure, and respect risk, so execution decisions are informed rather than emotional.

○ Disclaimer :- The information shared on this platform is for educational and research purposes only and does not constitute investment advice or recommendations. Market participation involves risk and outcomes are not guaranteed. Users are encouraged to make independent decisions based on their own assessment and risk tolerance.